santa clara property tax due date

Learn all about Santa Clara County real estate tax. SANTA CLARA COUNTY CALIF The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022.

The bills will be available online to be viewedpaid on the.

. Ad Property Taxes Info. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. 2022 County of Santa.

The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. This tax payment is based on property values determined for the January lien date 15 months earlier. Last day to file a business personal property statement without.

In establishing its tax rate Santa Clara must respect Article VIII Sec. See Results in Minutes. MondayFriday 900 am400 pm.

Slot is located on the southeast corner of the building near the entrance adjacent to the parking lot. Standard Data Record SDR. E-Filing your statement via the internet.

The Department of Tax and Collections in. There are three ways to file the Business Property Statements 571-L 1. 21 a of the Texas Constitution.

County of Santa Clara Department of Tax and Collections - Property tax frequently asked questions. Last Payment accepted at 445 pm Phone Hours. Santa Clara County collects on average 067 of a.

Enter Any Address Receive a Comprehensive Property Report. Santa Clara County property taxes are coming due and the due date is a major topic of discussion for home and business owners. The County of Santa Clara assumes no responsibility arising from use of this information.

The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021 property taxes is due. ASSOCIATED DATA ARE PROVIDED WITHOUT WARRANTY OF ANY KIND either expressed or. Actually tax rates mustnt be increased before the general public is previously.

Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local. When Are Property Taxes Due in Santa Clara. MondayFriday 800 am 500 pm.

Send us a question or make a comment. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. If the due date on the bill falls on Saturday Sunday or a County holiday payments.

Standard paper filing 3. The bills will be available online to be viewedpaid on the same day.

Up 10 In The Past Month Can Qualcomm Stock Continue Outperforming

Related Santa Clara Development Set To Start Later This Year

2022 Mountain View Tax Deadlines

2022 Mountain View Tax Deadlines

Ousted Santa Clara Commissioner Lied About Residency San Jose Spotlight

Property Tax Collector S Office Berkeley Advanced Media Institute

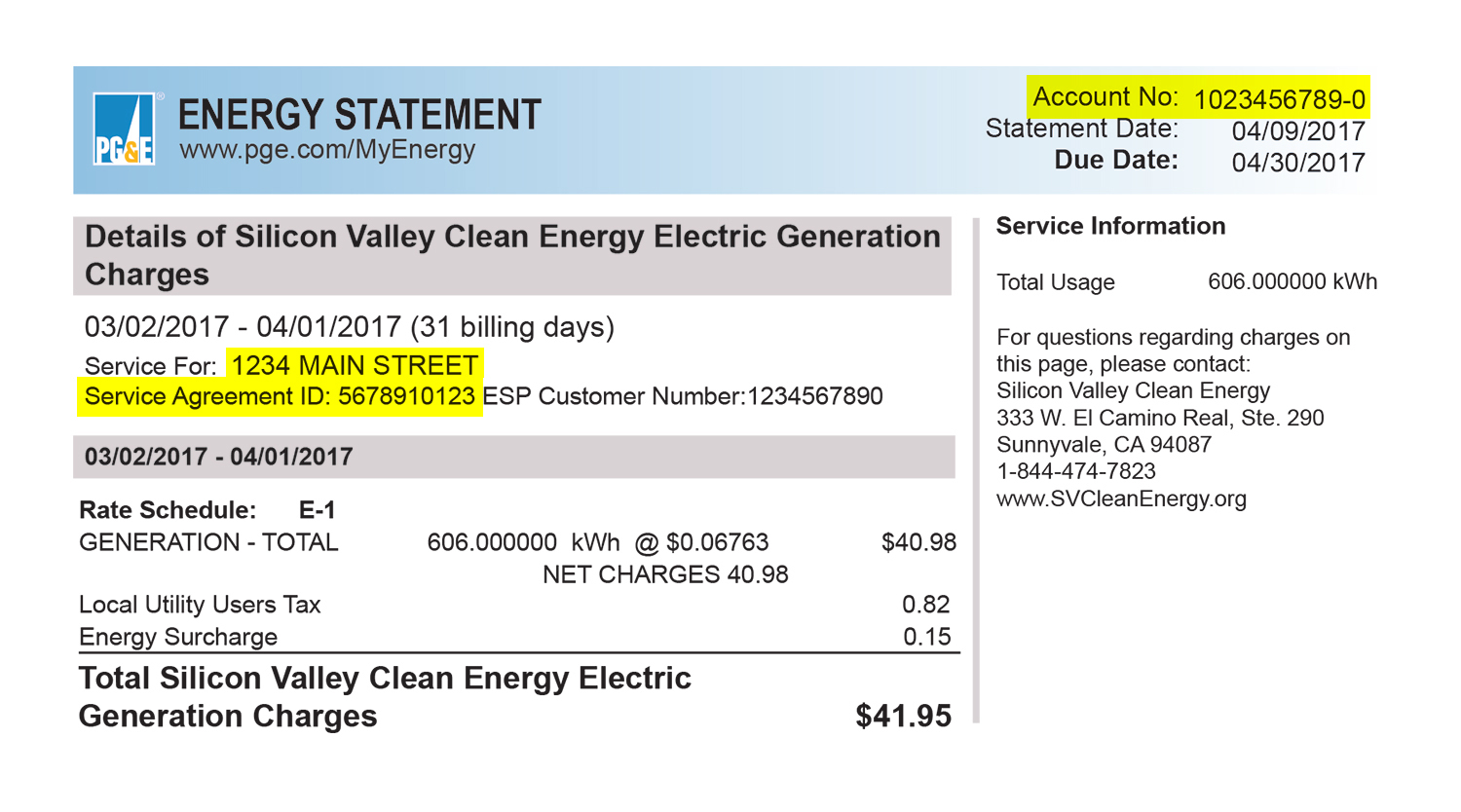

How Can I Be Eligible For Silicon Valley Clean Energy Svce Funds Calevip

Unsecured Property Taxes Treasurer And Tax Collector

Mozilla Foundation Mcv Our Voices Model And Methods Competition Taking Part

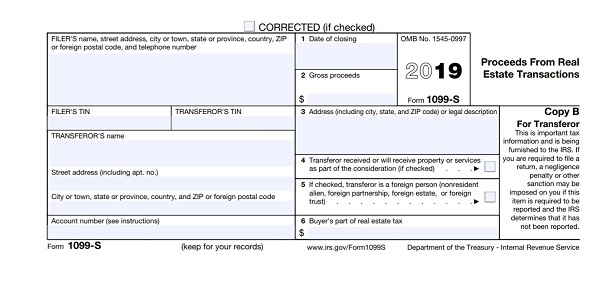

Should I Sign A Quitclaim Deed During Or After Divorce

Can I Receive A Refund From The Irs For Overpaid Taxes San Jose Ca Tax Lawyer

/cloudfront-us-east-1.images.arcpublishing.com/gray/TT232ZGFP5PGFJDLPW3GFC7OOY.jpg)